Video GuideConversational AI banking scales the personal touch consumers crave

AI-powered messaging via chatbots allows financial institutions to drive revenue, cut costs, and increase engagement rates by 20%. Watch the 5-minute video guide on how to adopt conversational AI solutions for the banking industry.

Why is conversational AI in banking so important?

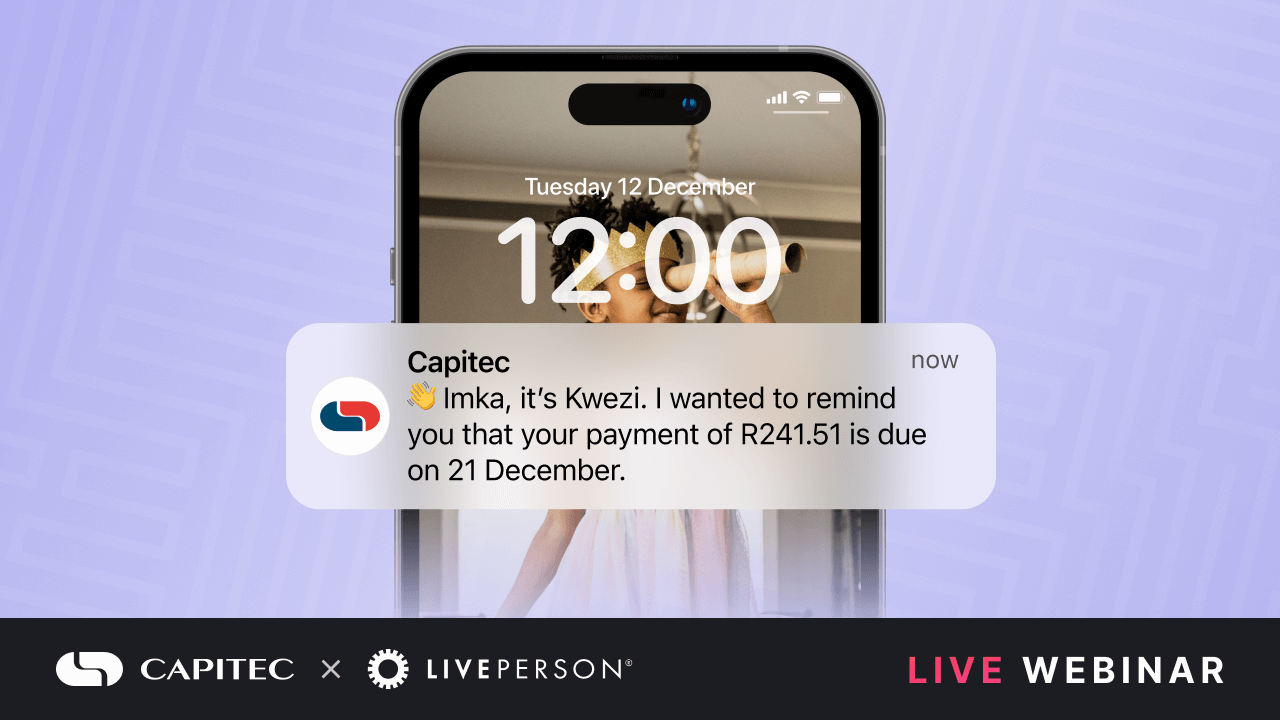

Interpersonal relationships are one of the pillars of a banking experience and key to customer satisfaction. The move to digitize banking doesn’t have to change that. With conversational AI solutions, you can still deliver a trusted, personalized experience with a combination of thoughtfully designed AI agents, AI-powered chatbots, and human agents. Not only does conversational banking make personalization scalable without sacrificing compliance, but it also increases customer interactions and engagement by 20% or more.

In a conversational banking approach, chatbots act as virtual assistants to handle the easy work — like gathering customer data and FAQs — for a fully automated experience. They can also quickly and accurately route customers to the right human agents to handle more complex and personal instances. And it all happens in the mobile channels banking customers love, like Apple Messages for Business, WhatsApp, SMS, and even social channels like Facebook Messenger.

Complete the form above to access the full-length conversational AI banking video guide and learn how it can transform your customer experience in four specific areas.